Chicago—A new survey from Information Resources, Inc. (IRI) has found that 78 percent of both lower- and higher-income consumers believe private label products are typically of excellent quality, according to a new study, “Private Label 2009: Understanding and Mitigating Private Label Threat.” The research provides a review of private label performance and best practices across channels, categories and retailers as well as current viewpoints from more than 1,500 consumers.

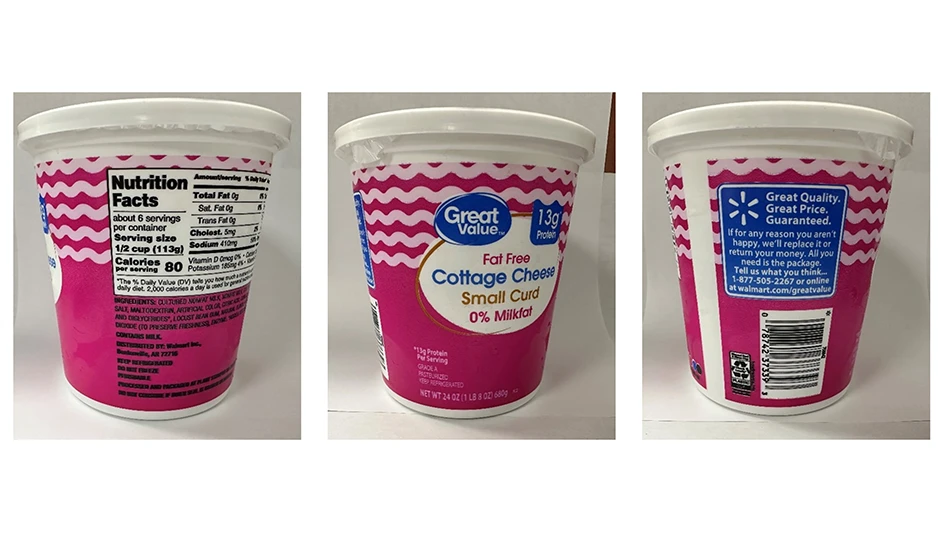

According to the report, during the first half of 2009, private label unit share increased in five of six departments, led by fresh/perishables and followed by healthcare and frozen foods. Private label dollar share has increased in 13 of 15 sales categories, with natural cheese, butter and canned vegetables leading the way and refrigerated fresh eggs, milk and frozen seafood trailing in the categories.

Private label’s strongest growth performance tends to be within commodity-driven categories without a dominant national brand and with relatively low innovation. Retailers are in command in categories such as butter, natural cheese, processed cheese and facial tissue and are developing in categories such as peanut butter, pet supplies and cookies. Private label growth is slowing in coffee creamer, frozen seafood and refrigerated meat. And, national brands clearly have command in vitamins, frozen breakfast foods and shelf-stable dinners.

In addition, nearly two-thirds of shoppers often buy private label products instead of name brands, and all age groups and income levels show a relatively strong propensity to purchase private label.

More information on the report is available at IRI.

Latest from Quality Assurance & Food Safety

- Director General of IICA and Senior USDA Officials Meet to Advance Shared Agenda

- EFSA and FAO Sign Memorandum of Understanding

- Ben Miller Breaks Down Federal Cuts, State Bans and Traceability Delays

- Michigan Officials Warn Recalled ByHeart Infant Formula Remains on Store Shelves

- Puratos USA to Launch First Professional Chocolate Product with Cultured Cocoa

- National Restaurant Association Announces Federal Policy Priorities

- USDA Offloads Washington Buildings in Reorganization Effort

- IDFA Promotes Andrew Jerome to VP of Strategic Communications and Executive Director of Foundation