Courtesy Decernis

With the COVID-19 pandemic is causing significant supply chain disruptions, Decernis COO Kevin Kenny has identified some key supply chain issues to watch going forward, including:

- The abject lack of migrant agricultural workers, coupled with the closing of restaurants and schools causes a steep drop in demand, leaving very large swaths of food “un-processible” – pork, eggs, milk, early harvest fruit and vegetables are all being destroyed or tilled under.

- Animal farmers are reporting problems affording feed as prices spike.

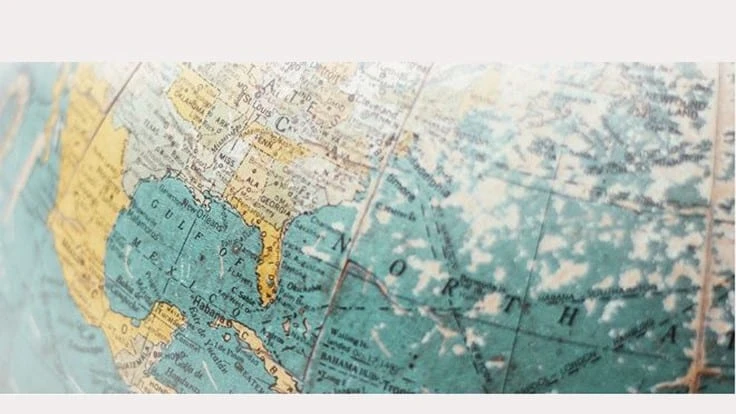

- India, unlike other countries, chose a complete shutdown, where even dietary supplement, spice and pharma production were not considered essential. So, everything sourced from India is currently disrupted, and it will take some time to undo that damage. “I expect the knock-on effects to be even greater as Western companies rethink supply chain exposure,” Kenny said.

- Passenger aircraft account for the majority of air-cargo volume in the world. With numerous airlines grounding the majority of their passenger fleets, there is an unprecedented shortage of cargo capacity – meaning delays and dramatic short-term air freight price increases.

- “Even before COVID-19 hit, there was a trend – initiated by the U.S. among others – toward overt ‘me-first’ nationalism,” Kenny said, adding, that trend has greatly accelerated in 2020 as countries stop the export of “key” commodities, including Cambodia, India, Kazakhstan, Russia, Serbia, and Ukraine. Critical supplies are also being diverted to more developed countries which can outbid and pay higher prices, and food security risk is growing in smaller and poorer markets, he said.

- “Obvious bankruptcy candidates include movie theaters, airlines, cruise ships, retailers and hotels. However, any company caught carrying a large debt load is suddenly endangered, including also well-known food companies such as AB InBev (lost sports revenue), Campbell’s (fortunately divested $3B in 2019) and Kraft Heinz (both of the latter are seeing processed food sales spike due to hoarding), pharma companies such as Merck, Mallinckrodt and Teva and other clients in the oil, gas and petrochemicals industry also effected by the perfect storm of oil market collapse).” And, he said, “There will be more bankruptcies.” As an early trend indicator, 247,000 Chinese companies declared bankruptcy in the first two months of 2020, with many more closures expected.

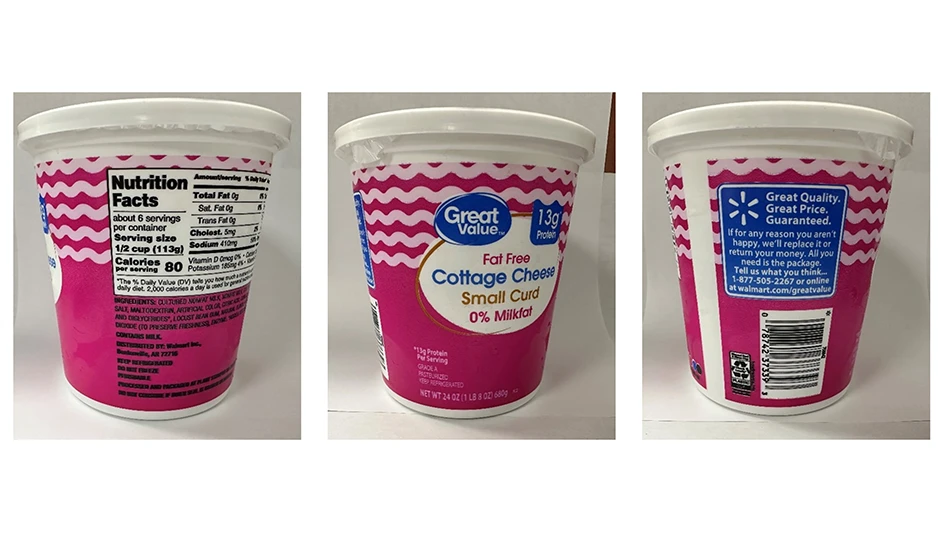

- On a positive note, supplement (e.g. Vitamin B, C, D etc.), food commodity (blueberries, oranges), or processed food products (juices, yoghurts) which are widely perceived to have immunity boosting potential will have both short and permanent long-term boost in sales. Botanicals, however, may soon have significant new sourcing problems.

“In the medium and long term, entire supply chains will need to be rethought,” Kenny said, explaining that the inexpensiveness of China, India, Vietnam and Thailand will now be weighed against the newly obvious threats to supply chain stability. In addition, the recent supply chain trend had been toward large multinationals partnering with fewer providers with much deeper relationships. “After being burned by force majeure, I expect that this trend may be reversed once the dust settles.”

As a global food safety expert, Kenny also is a member on the Regulatory Affairs Committees of several major food, cosmetic, and consumer product associations in the U.S. and Europe.

Latest from Quality Assurance & Food Safety

- Director General of IICA and Senior USDA Officials Meet to Advance Shared Agenda

- EFSA and FAO Sign Memorandum of Understanding

- Ben Miller Breaks Down Federal Cuts, State Bans and Traceability Delays

- Michigan Officials Warn Recalled ByHeart Infant Formula Remains on Store Shelves

- Puratos USA to Launch First Professional Chocolate Product with Cultured Cocoa

- National Restaurant Association Announces Federal Policy Priorities

- USDA Offloads Washington Buildings in Reorganization Effort

- IDFA Promotes Andrew Jerome to VP of Strategic Communications and Executive Director of Foundation