Global Market Insights

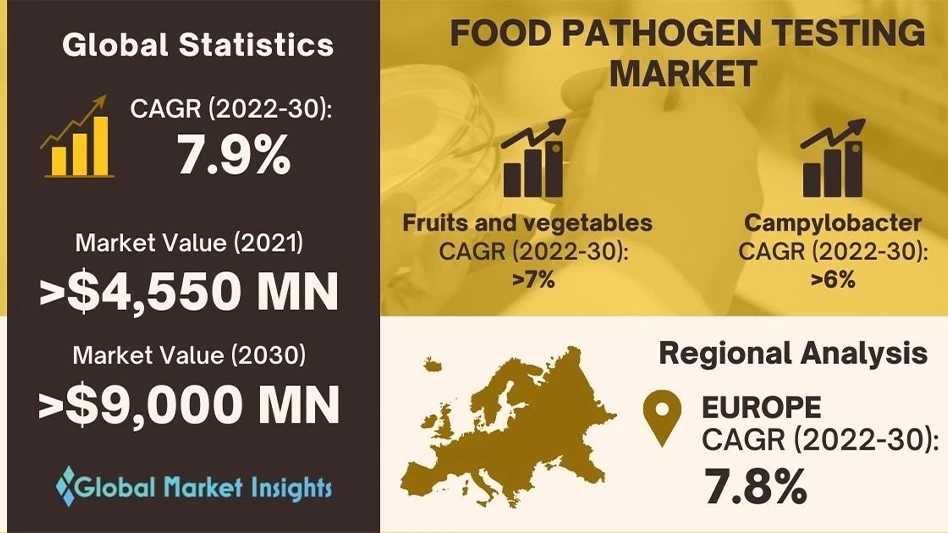

SELBYVILLE, Del. — As per the report published by Global Market Insights Inc., the global Food Pathogen Testing Market size is estimated to cross $9 billion by 2030, progressing at a compound annual growth rate of 7.9% from 2022 to 2030.

A few of the leading industry drivers include the presence of key food safety regulations and strict monitoring by food safety organizations. For instance, in the UK, the Food Safety Agency (FSA) was established to address the concerns associated with outbreaks of foodborne illnesses caused by pathogens. Implementation of programs focusing on imported foods, hygiene policy, and compliance to reduce foodborne disease will foster pathogen testing developments.

Lack of awareness and compliance with food & safety norms among manufacturers in developing countries, in addition to infrastructure deficit, are key factors that could hamper the industry growth. A shifting focus toward advanced storage infrastructure, enhanced food control capabilities and improved awareness may help to tackle the market restrictions.

Rising incidences of food poisoning necessitates campylobacter contaminant testing

The study finds that global food pathogen testing market share from campylobacter contaminants will depict over 6.5% CAGR from 2022 to 2030. Campylobacter is a bacteria associated with food poisoning and bacterial gastroenteritis. It causes foodborne illnesses via consumables such as contaminated chicken, raw dairy products, and undercooked meat. Rising incidences of foodborne illnesses in developed countries with greater consumption of processed or raw meat will expand the use of pathogen testing.

Pathogen testing requirements increase for fruits & vegetables

Food pathogen testing is prominently done for fruits and vegetables to detect GMOs, chemicals, pesticides, and pathogens, says the report. There is a complex supply chain comprising a long cycle of distribution and consumption for the products. Fresh fruits and vegetables stock needs multiple interventions for quality assessment and pathogen testing prior to consumption. The food pathogen testing market share from fruits and vegetables segment is anticipated to exhibit over 7% CAGR between 2022-2030.

Europe to witness large-scale investment in healthcare infrastructure

Europe food pathogen testing market share will expand at nearly 7.8% CAGR up to 2030. The region has witnessed strong efforts to strengthen food security, safety, and hygiene for consumers. Rising investments in overall healthcare infrastructure will support the industry outlook. European governments have invested several billion dollars in local healthcare infrastructure to address outbreaks of foodborne diseases. For example, in 2021, the government in Poland had announced an investment worth over USD 1.6 billion for enhancing its healthcare sector over the coming years.

As the impact of the COVID-19 crisis declines, food manufacturing companies will look to reinforce their supply chain capabilities to ensure better product safety. The changing trends and challenges brought on the pandemic has created a need to develop more secure and sustainable supply chain networks. High consumption of dairy, cereals, packaged meat products and fruits in emerging economies will augment food pathogen testing applications across regions such as Asia Pacific, MEA and Latin America.

The competitive landscape of food pathogen testing industry is comprised of leading organizations such as Lloyd's Register Quality Assurance Limited, Campden BRI, Det Norske Veritas As (Dnv), ILS Limited, RapidBio Systems, Inc., Agilent Technologies, Thermo Fisher Scientific Inc, SGS S.A., Intertek Group PLC, Eurofins Scientific, Asurequality, ALS Limited, Genetic Id Na Inc., Silliker, Inc., Genon Laboratories Ltd, and Genevac Ltd., among many others. These firms are focused on expanding their market position by means of new regional partnerships and acquisitions.

Latest from Quality Assurance & Food Safety

- FDA Releases Produce Regulatory Program Standards

- Invest in People or Risk the System: Darin Detwiler and Catalyst Food Leaders on Building Real Food Safety Culture

- USDA Proposes Increasing Poultry, Pork Line Speeds

- FDA Releases New Traceability Rule Guidance

- TraceGains and iFoodDS Extend Strategic Alliance

- bioMérieux Launches New Platform for Spoiler Risk Management

- SafetyChain Receives SOC 2 Type 2 Certification

- Puratos Acquires Pennsylvania-Based Vör Foods