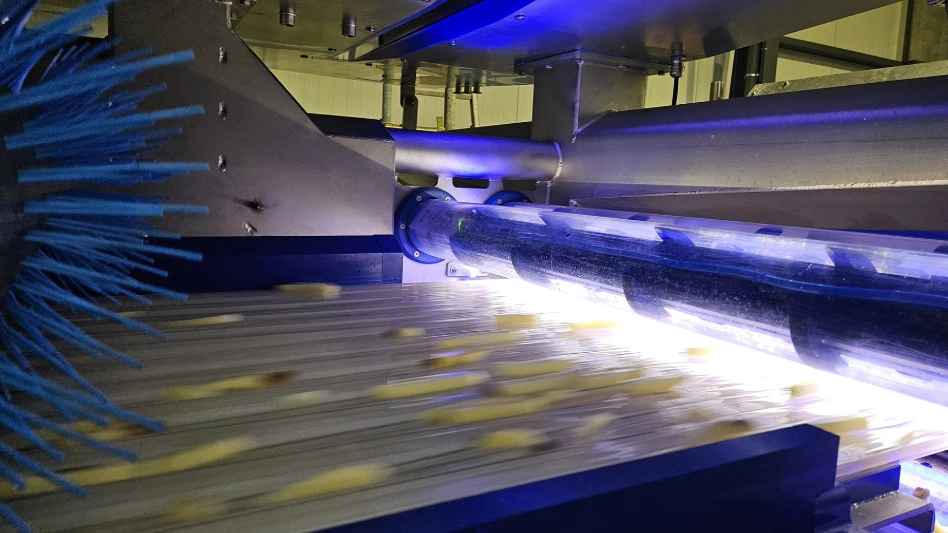

Courtesy Ferrero

LUXEMBOURG and BATTLE CREEK, Mich. — The Ferrero Group will acquire WK Kellogg Co for $23 per share in cash, representing a total enterprise value of $3.1 billion. The acquisition includes the manufacturing, marketing and distribution of WK Kellogg Co’s portfolio of breakfast cereals across the United States, Canada and the Caribbean.

The transaction is part of Ferrero’s strategy to acquire, invest in and grow iconic brands as it enhances its North American footprint and product offerings, said the company in a July 10 release.

Ferrero and affiliated companies employ more than 14,000 across 22 plants and 11 offices in North America. The North America portfolio includes Nutella, Kinder, Tic Tac, Ferrero Rocher, Butterfinger, Keebler and Famous Amos. It also includes confectionery brands like Jelly Belly, NERDS and Trolli, as well as frozen treat brands like Blue Bunny, Bomb Pop and Halo Top.

Drawing upon previous acquisitions in the United States, Ferrero plans to invest in and grow WK Kellogg Co’s brands, including Frosted Flakes, Froot Loops, Frosted Mini Wheats, Special K, Rice Krispies, Raisin Bran, Kashi, Bear Naked and more that are well-loved by American consumers, the company said.

WK Kellogg Co has been in operation for nearly 120 years, and Ferrero for more than 75 years. The company said it has long admired WK Kellogg’s legacy and is proud to be entrusted with carrying iconic American brands forward.

"I am thrilled to welcome WK Kellogg Co to the Ferrero Group,” said Giovanni Ferrero, executive chairman of the Ferrero Group. “This is more than just an acquisition — it represents the coming together of two companies, each with a proud legacy and generations of loyal consumers. Over recent years, Ferrero has expanded its presence in North America, bringing together our well-known brands from around the world with local jewels rooted in the U.S. Today's news is a key milestone in that journey, giving us confidence in the opportunities ahead."

Gary Pilnick, chairman and CEO of WK Kellogg, said, “We believe this proposed transaction maximizes value for our shareowners and enables WK Kellogg Co to write the next chapter of our company’s storied legacy. Since becoming an independent public company in October 2023, we have made excellent progress on our journey to become a more focused and more profitable business — driven by our tremendous people and a winning culture — all while building a strong foundation for future growth. Joining Ferrero will provide WK Kellogg Co with greater resources and more flexibility to grow our iconic brands in this competitive and dynamic market. As a family-owned, private company with values in line with our founder W.K. Kellogg, Ferrero provides a great home for our people and has a track record of supporting the communities in which it operates. We look forward to collaborating with their team to deliver on the great promise of cereal, explore opportunities beyond cereal and help us bring our best to consumers every day.”

Lapo Civiletti, CEO of the Ferrero Group, added, "WK Kellogg Co, a trusted company with beloved brands, represents a meaningful addition to the Ferrero Group. Enhancing our portfolio with these complementary household brands marks an important step towards expanding Ferrero’s presence across more consumption occasions and reinforces our commitment to delivering value to consumers in North America."

Similar to WK Kellogg Co, Ferrero said traces its roots to humble beginnings as a family business, still operating in the town where it was founded. After the transaction closes, Battle Creek, Mich., will remain a core location for the company, said Ferrero, and will be Ferrero’s headquarters for North America cereal.

Transaction Details.

Under the terms of the agreement, Ferrero will acquire all outstanding equity of WK Kellogg Co. Upon completion of the transaction, shares of WK Kellogg’s common stock will no longer trade on the New York Stock Exchange, and the company will become a wholly owned subsidiary of Ferrero.

The agreement has been unanimously approved by the WK Kellogg Board of Directors.

The transaction is subject to approval by WK Kellogg shareowners, regulatory approvals and other customary closing conditions and is expected to close in the second half of 2025, according to Ferrero.

The W.K. Kellogg Foundation Trust and the Gund family have entered into agreements pursuant to which they have committed to vote shares representing 21.7% of WK Kellogg’s common stock, as of July 7, in favor of the transaction.

Lazard is acting as lead financial advisor, with BofA Securities acting as co-advisor and Davis Polk & Wardwell LLP serving as legal counsel to Ferrero. Goldman Sachs and Morgan Stanley are acting as financial advisors and Kirkland & Ellis LLP is serving as legal counsel to WK Kellogg.

WK Kellogg Announces Preliminary Second Quarter Net Sales.

In connection with the announcement, WK Kellogg provided preliminary second quarter 2025 net sales and Adjusted EBITDA results. For the second quarter, ended June 28, the company expects net sales to be in the range of $610 million to $615 million and adjusted EBITDA to be in the range of $43 million to $48 million.

These preliminary results are estimates based on information available to management as of July 10 and are subject to change upon completion of the company’s standard closing procedures and review by its independent registered public accounting firm.

WK Kellogg will issue its full second quarter results and related financial information on Aug. 5. A press release will be available on the company's website that morning at 8 a.m. EST. Visit investor.wkkellogg.com to access these materials.

Due to the pending transaction, WK Kellogg Co will not host a webcast to discuss its second quarter 2025 results.

Latest from Quality Assurance & Food Safety

- FDA Releases Produce Regulatory Program Standards

- Invest in People or Risk the System: Darin Detwiler and Catalyst Food Leaders on Building Real Food Safety Culture

- USDA Proposes Increasing Poultry, Pork Line Speeds

- FDA Releases New Traceability Rule Guidance

- TraceGains and iFoodDS Extend Strategic Alliance

- bioMérieux Launches New Platform for Spoiler Risk Management

- SafetyChain Receives SOC 2 Type 2 Certification

- Puratos Acquires Pennsylvania-Based Vör Foods